SDG Impact Japan, Inc. (“SIJ”) has established a joint venture with Electric Power Development Co.,Ltd. (“J-Power”), the Japanese major independent power producer, to promote Joint Crediting Mechnism (JCM) [1] generated from hydropower projects operated by PT Mulya Energi Lestari (“MEL”), the developer and operator of hydropower projects in Indonesia. J-Power and SIJ will invest in MEL through a newly established Joint Venture Company.

SIJ has been providing support to MEL’s business through its wholly owned subsidiary, SIJ Climate LLC (“SIJ Climate”), and has decided to collaborate with J-Power to expand MEL’s operation through capital injection and cooperation in JCM credits.

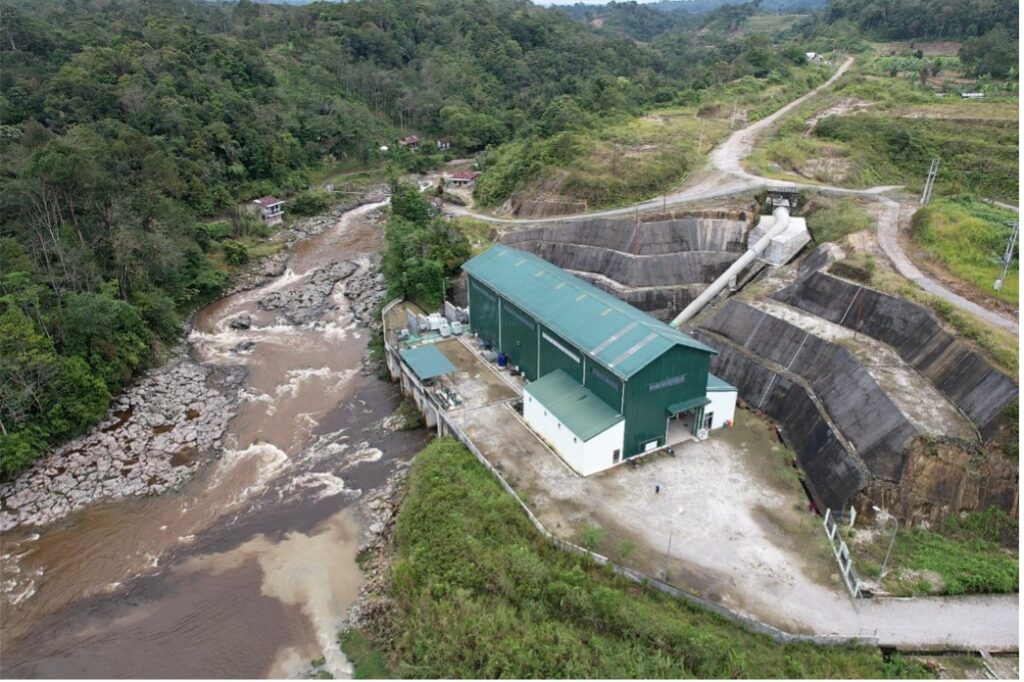

MEL is an operating company established in 2016 that develops, constructs, and operates hydropower projects, including those under development, mainly in North Sumatra, with a total capacity of 52.5 MW. The hydropower projects developed by the company are the “run-on-river” method which has smaller impact to the surrounding environment compared to the dam type project. The hydropower is suitable for North Sumatra since there are many rivers with large drop-offs and stable water volume throughout the year.

The hydropower project developed by MEL will contribute to the energy transition of Indonesia by expanding renewable energy capaciy. Also, the project will aims to contribute to the achievement of NDC target [2] not only for Indonesia but also for Japan through the JCM scheme, the carbon credit aligned to Article 6.2 of Paris Agreement. The investment in MEL is positioned not only as investment to renewables, but also as the approach to promote JCM credit initiative. The new joint venture company will also handle the JCM credits acquired by MEL.

Japan and Indonesia have set targets to achieve carbon neutrality by 2050 and 2060, respectively. The public and private sectors are promoting decarbonization efforts to achieve the NDC targets. In recent years, the carbon pricing schemes have been gradually taking shape in both countries, and emissions trading markets are being developed, etc. JCM credits are carbon credits that comply with the Paris Agreement, and are expected to be utilized in carbon pricing schemes. Demand is expected to increase in the hard-to-abate industry, where it is difficult to reduce CO2 emissions.

Through the joint investment in MEL, J-Power and SIJ will work to promote energy transition and climate change mitigation in the country by combining J-Power’s technical capabilities and operational experience in hydropower projects in Japan and abroad with SIJ’s experience and network in climate change finance and carbon credits.

[1] With regard to JCM, the Cabinet has decided to utilize JCM for the reduction target of NDC (Nationally Determined Contribution) and has set a target [2] to secure a cumulative 100 million t-CO2 of JCM credits by 2030, and a new system (private sector JCM) is being designed through financial contributions from private companies. Please refer to the information in this link.

[2] Please refer to the link for NDC (nationally determined contribution) reduction targets

PT Mulya Energi Lestari

Address: SATRIO TOWER, 15th Floor Jl. Prof. Dr. Satrio Kav. 1-4 Block C4 Jakarta Selatan, Indonesia

Founded: August 2016

Website: https://mulyaenergilestari.com/mel-home-en/

Electric Power Development Co.,Ltd. (“J-Power”)

Address: 6-15-1 Ginza, Chuo-ku, Tokyo

Representative: Hitoshi Kanno, President and Chief Executive Officer

Founded: September 1952

Website: https://www.jpower.co.jp/english/

SDG Impact Japan Inc.

Address: 7F Kishimoto Bldg., 2-2-1 Marunouchi, Chiyoda-ku, Tokyo, Japan

Representative: Mari Kogiso, Shohei Maekawa, Co-CEO

Founded: January 2021

Website: https://sdgimpactjapan.com/