On July 4, SDG Impact Japan (SIJ) and fermata Inc. (fermata) co-hosted an event titled “Femtech Market Momentum and Potential Based on Domestic and International Market Trends and Case Studies” for businesspersons interested in femtech area.

In the first half of the event, Amina Sugimoto (“Amina”), CEO of fermata and a doctor of public health, and Sho Masubuchi, who is in charge of SIJ’s gender impact investment strategy, took the stage to give an overview of current and outlook of femtech market. In the latter half of the session, participants discussed the theme of “What kind of cooperation and measures are necessary to accelerate the femtech market in Japan?”

Speakers

fermata Inc.

Amina Sugimoto,

Representative Director and CEO Dr.,

Ph.D. in Public Health from the London School of Hygiene & Tropical Medicine. She has conducted research on internal and external radiation exposure and health management of the victims of the Fukushima Daiichi Nuclear Power Plant accident and is a member of the National Diet of Japan Fukushima Nuclear Accident Independent Investigation Commission. She is also a member of the National Diet of Japan Commission of Inquiry into the Accident at TEPCO’s Fukushima Daiichi Nuclear Power Station. She was also selected as a Young Professional Member of the Ministry of Health, Labour and Welfare (MHLW), and was involved in writing “Strengthening the Global Health System: Recommendations for the G7 Ise-Shima Summit and the Kobe Health Ministers’ Meeting”. Recently, she joined Mistletoe Inc. and is also a former member of All Turtles, an AI startup studio led by former evernote CEO Phil Libin.

SDG Impact Japan Inc.

Sho Masubuchi

While in university, he started his own business in the field of education (developing PBL and active learning type teaching materials).

After graduation, he worked for a venture company and then joined GLOBIS Corporation, where he launched and managed an accelerator program for seed-stage startups. From 2021, he has been engaged in investment-related work at Globis Capital Partners. He graduated from the Faculty of Policy Management at Keio University.

4.5 trillion yen of economic loss due to women’s health issues, combined with potential needs.

Amina: The term “Femtech” was coined around 2016, and we at fermata first introduced the term to Japan in 2019. Although the femtech market in Japan has a special focus on femcare products, please understand that the essential femtech market is not limited to women-specific health issues, but also includes products and services created to visualize and solve health issues such as symptoms and diseases that tend to be more prevalent in women, through the power of technology.

Recently, the Ministry of Economy, Trade, and Industry (METI) has put forth a figure of “3.4 trillion yen” for the economic loss that women’s health challenges can cause to Japanese society. However, at the beginning of 2019, the government still did not know how much economic loss would result from not addressing women’s health challenges.

Although the figure of 3.4 trillion yen has been put forth, femtech’s seed market is only providing solutions to “visible health issues”. When combined with the economic losses caused by potential issues that have not yet been visualized, this is an area with the potential to expand its impact even further.

The term “Femtech” was created against the backdrop of the gender gap.

Amina:The growth rate of the global femtech market is said to be roughly 8.8% to 14%. Since the growth rate of the medical device market is about 5.5%, we can say that the growth rate is expected to be much higher than that. The market size is estimated to be 100 to 150 trillion yen.

However, the venture investment world is overwhelmingly dominated by men. Globally, “the percentage of venture capital funding received by companies founded solely by women” is less than 3%, and in Japan, “the percentage of funding received by the top 50 fundraising companies that include women as founders or presidents” is only 2%. The gender gap in the global medical research industry is also significant, with only 2% “of medical research funding spent on pregnancy, childbirth, and women’s reproductive health”.

In the midst of this gender gap, the term “Femtech” was created to indicate that there is a need and business potential for products and services that solve women’s health issues.

Harvard Professor Claudia Goldin, who won the Nobel Prize in Economics in 2023, grouped U.S. women by year of birth to show “how they tend to choose between family, work, and career.” It is helpful to think of “work” here as work done out of necessity for living, and “career” as a choice for personal growth. The professor is asking what kind of choice would be made by the sixth group after birth year 1978, as more women in the fifth group after birth year 1958 are able to choose both career and family.

When this is applied to Japan, I believe that Japan has not yet reached the sixth group. But our choices and way of life are certainly changing. I think femtech could fill the gap.

Due to this background, I believe that the term “Femtech” is beginning to be recognized in Japan. On the other hand, however, I think the fact that “tech” has not penetrated the market because of the focus on femcare. And this probably is a factor that has sensibly stagnated the variation in the femtech area in Japan.

Matching healthcare and tech is a challenge

Masubuchi: I think it is good that femcare products have caught on. Considering how technology can be multiplied into it, funding for femtech is still insufficient. Globally, there are about 15 IPOs and 150 M&As as of 2024, and they are growing from startups to companies that create an impact on society. On the other hand, in Japan, the company has remained limited to femcare products and thus lacks a sense of scale. We see a need for investment in femtech in Japan as well as globally.

I feel that there is not much difference in the ability of entrepreneurs between Japanese and foreign startups, but where do you attribute this difference in scale?

Amina:I think there are several factors, but one is that Japan is not very strong in the health tech area. The cost of visiting a hospital is not so high because of universal health insurance, and it is cheaper and faster to go directly to a hospital than to see a doctor remotely. There are other reasons, but I think the current health system is also a factor in the lack of digitization of healthcare.

In particular, there are currently about 2,500 obstetrics and gynecology clinics in Japan, but they are declining at a rate of about 5% per year. Compared to the 60,000 dental clinics, for example, there is almost no competition. Under such circumstances, it is difficult for obstetricians and gynecologists to think of differentiating themselves by embarking on online medical care.

Meanwhile, the need for obstetrics and gynecology is moving away from the needs of the previous generation of obstetricians to the subsequent generation, including menopause. There is a definite market there, and self-funded medical treatment is growing. So much so that 65-70% of obstetrics and gynecology revenue now comes from self-funded medical treatment. Despite this need, the need is not being met because the medical and tech industries are not well matched. Obstetrics and gynecology are not being digitized and femtech solution is not being introduced. To change this, medical experts and physicians need to enter the femtech space.

Masubuchi: Due in part to the influence of fermata and others who have pioneered the femtech area, I feel that there is a change in the sense of the medical field. In the government as well, deregulation of insurance coverage of infertility treatment and pill prescriptions, and deregulation of online medical treatment are also in progress.

Online medical services are actually emerging in Japan as well. For example, Melody International Ltd. offers a fetal monitoring service that uses IoT devices to allow patients to see the status of their fetus at home and access it from the hospital side.

We feel that now is the right time to turn our attention to the theme of femtech, as both government and people are beginning to change along with the changing social atmosphere.

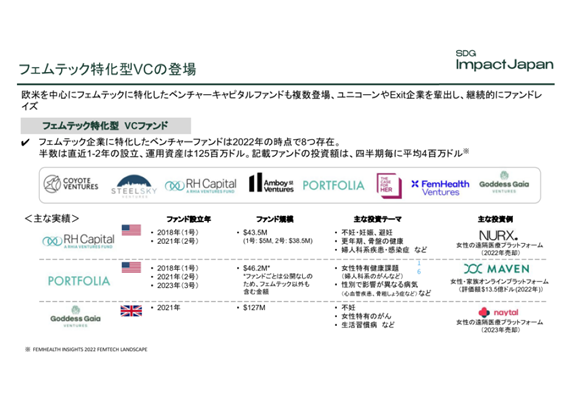

Emergence of femtech-specific VC and femtech IoT

The emergence of a VC specializing in femtech.

Masubuchi: Looking at the situation surrounding femtec overseas, venture capital (VC) firms that specialize in investing in the femtec theme have emerged.

These days, VC funds are becoming larger and larger, with an increasing number of funds investing in companies that are known as unicorns. On the other hand, there are also an increasing number of specialized funds that not only pursue size, but also specialize and invest in themes with social impact or niche themes.

Since around the late 2010s, theme-specific funds that focus on investing in women’s healthcare and wellbeing have emerged. As many as 10 such funds have sprung up that we are aware of. While it is difficult to accurately assess the status of funds based on external information alone, several funds appear to be doing well based on fundraising trends.

Amina:U.S. gender-focused funds are unique in that they are return-oriented funds, but they are also funded by family offices, foundations, etc. RH Capital is a good example of this.

Masubuchi: Please take a look around RH Capital and PORTFOLIA. If you look at the investment destinations of specialized VC firms, you will find a lot of useful information about what themes they focus on and invest in.

How to accelerate the femtech market in Japan? (Discussion)

Amina:I feel that access is the biggest issue.. Both companies and governments have recognized the need to address women’s health issues and promote women’s activities, but the actual lack of access to products and services, and the lack of delivery of goods, is a challenge in Japan.

To overcome this challenge, we need consumers, researchers, government, investment, and various players, and focusing on one will not work.

We have somehow managed to create a market over the past four years, connecting with celebrities, influencers, and school teacher conferences. We have also reached out to the media. However, even when we tried to launch products, most products and services could not be introduced due to strict regulations. Japan’s pharmaceutical regulations are designed to be relatively easy for consumers to use. However, because it was created without understanding the needs of women’s health, the rules are not designed for the introduction of femtech as a medical device.

To change regulations, it is important to get medical experts interested, so we introduced femtech to doctors of the Society of Obstetrics and Gynecology, and fortunately, they became interested, and that was the beginning of a movement that we have responded to. We are also working to influence the government, for example, by setting up opportunities to exchange opinions with embassies in Europe and the United States.

We also held a workshop at an event for VC investors to help investors realize that there is a need and market potential for femtech. Investors who felt the enthusiasm surrounding femtech had a totally different sense of forward momentum.

Amina:In order to make people feel that “Femtech” is a theme that they should invest in, and not just a buzzword, we believe it is important to collaborate with LP investors to bring this theme to life. I think there is a great potential, such as in creating new business, M&A to meet need ofLP investors, collaboration between LP investors and VC funds in exchanging startup knowledge, and even designing the future together. In addition, we believe that it is important for VC to build an appropriately sized fund that can generate impact and return.

Participant: I feel that it is difficult to see the users of Femtec and Femcare products in Japan. What are the differences between Japan and the U.S. in terms of users?

Masubuchi: In general, it can be said that Japan has low incentives to “invest in preventive medicine” due to universal health insurance, while users in Europe and the U.S. have higher spending and sensitivity to preventive medicine.

On the other hand, there is considerable potential in Japan for services that take advantage of the hospital channel. For example, even if a pair of absorbent panties are on the shelf at a retail store, not many people will buy them, but if they are recommended by a hospital or a doctor, they will be more likely to buy them. While awareness of things like “prevention” and “mental health” is lower than in Europe and the U.S., trust in hospitals is high, so we see significant investment in things learned through hospitals.

Amina:I think the biggest difference is the regulations. Vested interests based on the current regulations are preventing the expansion of new markets. For example, even though 65-70% of the income of obstetrics and gynecology as mentioned above comes from self-funded medical treatments, only a small percentage of women in Japan have access to such services, and the majority of people do not have that access.

The market moves when something is created to fill this gap as a system, but both the medical and administrative sides are still working based on the existing system. However, when women’s lives change and the distortion created in their lives becomes apparent, the new market becomes larger than the vested interests, and the government begins to move accordingly. In Japan today, the biggest challenge is that it is difficult to see this distortion, and once it becomes visible, I believe positive movement will emerge.

Masubuchi: In the area of fertility treatment, the hypothesis mentioned by Amina-san is beginning to be proven.

Amina:Even though many changes are taking place, there is a problem that the system side, such as the medical community and government, has not caught up. In order to change this situation, it is important that capital is brought into the system and that services are introduced to solve the respective problems.

Masubuchi: When regulations change, new opportunities and challenges are created in the field, leading to the creation of new markets. And it is startups that are quick to take up the challenge.

In fact, in the area of fertility treatment where the system has been updated, several fertility treatment startups are working on DX for clinics. It is important how existing corporates and VCscan support startups to become solution providers of a new market.

Amina:Large companies have an overwhelming advantage in terms of community power and contact with users. Once a startup reaches a certain stage, large companies can scale up by investing their networks and resources. I think this is the point of change that will come in the next 5 to 10 years. And from an investor’s perspective, I think the time to buy is this one to two years, when the valuation of femtec has settled down.

Participant: When a company invests as a CVC, I think two points may make them hesitant to invest in the healthcare area, including femtech: “I don’t know the decision criteria (difficulty in identifying good startups in this field)” and “I can’t foresee results in a short period of time (within 3 years)”.

Masubuchi: I think it is one way to understand market trends and gather information on specific startups through investing in VC. Fund managers also provide materials, and the community of LP investors can analyze global trends, exchange informationand opinions.

In addition, femtech is a service for women, and given that any business or company has female customers and employees, it is one of the themes that will continously be involved in some way. For example, we believe that it is possible to report the results of the investment by establishing mid-term indicators such as whether the introduction of femtech’s services in the context of employee benefits will reduce turnover or increase employee satisfaction.

Participant: I feel that when the decision-making is done by male, it is difficult for them to see it as their own business, and will prevent from investing.

Amina: Globally, for example, the first male investor in Ida Ting of “Clue” has become a celebrity recognized as “cool” in the industry. It is important to create a trend of “cool” men who are interested in and working on women’s health issues, as well as women’s participation.

Even among the same woman, each person’s experience is different, and in some cases, being too close to the issue may cause a bias. In that sense, it may be better to have a certain distance between us so that we can be discerning and share our knowledge with you.

In any case, even if we could not experience each other’s gender, it would be better if we could make it in a “participatory” way, interested in each other’s potential needs when considering how to live in society. I hope there will be more “cool” investors!

Participants’ voices (excerpts)

- “I am still in the process of learning about the femtech area, and this was a good opportunity to learn about the market as a whole. In the future, I would like to work together with male supervisors and management to deepen my understanding of the business.”

- “There were many products and services of femtech that I did not know about. I would like to use them myself, and I felt it was important to expand awareness of them.”

- “I have been a VC investor for 10 years and now I reflect on the fact that when I learned about femtech in the U.S. 6-7 years ago, I thought “it’s not ready yet”. After participating in this event, I felt it was time to steer tofemtech.”

- “I think it would be interesting to combine femtech with a company that wants to demonstrate its value as a “good place to work” as the recruitment market in Japan is getting tougher and tougher. I would like learn about such examples in overseas.”

- “In order to ensure that our efforts related to femtech do not cease even if management changes, I felt that we must leave a portion of our business, whether in the D&I context or in the business development context, to be allocated to this area, even if it is a small budget.”

- “I think that the stance toward infertility treatment has changed dramatically since I became in charge of D&I three years ago. After studying today, I felt that the company’s stance on femtech will also change drastically in three years.”