Our CISO Sasja Beslik will be speaking at RI Japan 2024 on May 22nd.

RI Japan 2024Venue: Toranomon Hills ForumDate: 22-23 May 2024Session: Plenary 3: Countering the anti ESG backlash, does Japan have a meaningful role to play? https://www.peievents.com/en/event/ri-japan

5/6 Our carbon credit business was featured in the Nihon Keizai Shimbun

The Nihon Keizai Shimbun published an article about our support for the introduction of renewable energy in emerging countries such as Indonesia, Mongolia, and Turkey. https://www.nikkei.com/article/DGXZQOUC0863M0Y3A201C2000000/

4/24 Special Roundtable Discussion Featured in Zaikai

Under the theme of “What is the role of finance in solving social issues such as SDGs and ESG? The article featured a special roundtable discussion among Mr. Kamezawa, President of Mitsubishi UFJ Financial Group, Mr. Nagashima, President of Meiji Yasuda Life Insurance Company, and Mr. Tanika, Chairman of the Board of Directors of Zaikai […]

Announces Change in Co-CEO and Management Structure

SDG Impact Japan Inc. hereby announces a change in the Co-CEO and new management structure of SDG Impact Japan, Inc. (“SIJ”), a company specializing in sustainable finance, effective April 1, 2024, as follows. 1.Details of Management Structure Changes Current Title New Title Bradley Busetto Co-CEO Director, Vice Chairperson Shohei Maekawa COO Co-CEO 2.Background of Management […]

Additional Investment from Fuyo General Lease Co.Ltd. to invest in AgFunder SIJ Impact Fund

SDG Impact Japan Inc. (CEO: Mari Kogiso, hereinafter “SIJ”) and AgFunder Asia Pte. (Executive Director: John Friedman, hereinafter “AgFunder”), a Singapore-based venture capital firm jointly announced that Fuyo General Lease Co., Ltd. (Chiyoda-ku, Tokyo; Hiroaki Oda, President and Chief Executive Officer; hereinafter “Fuyo Lease”) has committed to invest in AgFunder SIJ Impact Fund (hereinafter “Fund”), […]

Advertising works in which co-CEO Mari Kogiso has appeared won an Nikkei BP’s Award

The Japan International Cooperation Agency (JICA)’s advertisement “The Future of Ukraine and the World with Akira Ikegami and us”, which our co-CEO Mari Kogiso has appeared, won the Grand Prix at the 10th Nikkei BP Marketing Awards (2024). https://www.nikkeibp.co.jp/atcl/newsrelease/corp/20240304/ https://www.nikkei.com/article/DGXZQOUC297UL0Z20C24A2000000/

We have been appointed as ambassadors of SusHi Tech Tokyo 2024 Global Startup Program

We are pleased to announce that we have been appointed as ambassadors of SusHi Tech Tokyo 2024 Global Startup Program. SusHi Tech Tokyo 2024 Global Startup Program” is the largest scale global innovation conference in Asia and the only one of its kind in Japan, which creates “unseen encounters” with startup ecosystems in Japan and […]

CEO Kogiso was featured in an advertisement for the Health Management Research Group

CEO Kogiso was featured in an advertisement for the Health Management Research Group that was published in the morning edition of the Nihon Keizai Shimbun on February 26th.She comments on the challenges and prospects for how companies should approach women’s health issues. https://kenko-keiei.jp/3178/

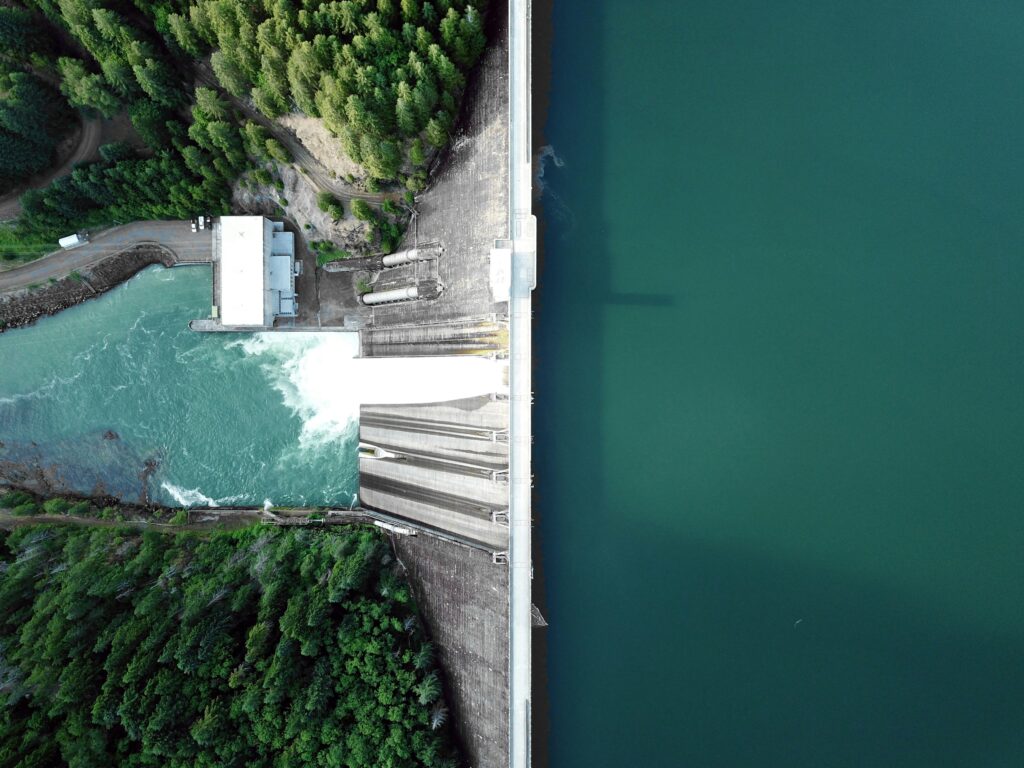

sustainacraft and SIJ to partner for high-quality nature-based carbon credit fund

The 10-billion-yen Nature Commitment Fund aims to acquire 9 million tons of nature-based voluntary and JCM credits. sustainacraft Co., Ltd. (Headquarter: Chiyoda-ku, Tokyo, Representative Director: Hiroshi Suetsugu, hereafter “sustainacraft”) and SDG Impact Japan (Headquarter: Chiyoga-ku, Tokyo, Co-CEO Mari Ogiso, hereafter “SIJ”) has agreed on working together to mobilize investment in high-quality nature-based carbon credits. The […]

Mari Kogiso’s interview was published in Nikkei Business on February 2nd

An interview with coCEO Mari Kogiso was featured in Chapter 4 of “The Future of Ukraine, the World, and Us”, a tie-up article between Nikkei Business and JICA. https://special.nikkeibp.co.jp/atclh/ONB/23/jica1115/chapter04/