Exploring the innovative role of Japan’s Joint Crediting Mechanism in climate finance and empowering sustainable initiatives in developing nations.

Our planet is facing an unprecedented challenge: the accelerating impacts of climate change. Extreme weather events are no longer rare occurrences but frequent reminders of a warming Earth. The Intergovernmental Panel on Climate Change (IPCC) has made it crystal clear: to cap global warming at 1.5°C above pre-industrial levels, immediate, transformative action is vital. The stakes are high—global greenhouse gas (GHG) emissions must be halved by 2030.

Yet, amidst these demanding targets, the global community struggles with financial commitments. While climate finance reached an average of $803 billion in 2019-20201, it remains insufficient. The commitment of developed countries to mobilize $100 billion in climate finance annually by 2020 through to 2025 has not yet been met. According to an Organisation for Economic Co-operation and Development report, developed countries provided and mobilized a total of $83.3 billion1 in climate financing for developing countries in 2020, a 4 per cent increase from 2019 but still shy of the target.

Developing countries face significant financial challenges in their efforts to combat climate change. The UNFCCC highlights that to meet their Nationally Determined Contributions (NDCs), they require close to $6 trillion by 2030. Additionally, the United Nations Environment Programme estimates that the costs for adapting to climate change could reach up to $330 billion annually by 2030 for these nations.

Enter Market-Based Mechanisms

Many nations are looking to market-based mechanisms as the key. These tools, leveraging economic incentives, are designed to reduce GHG emissions. One of the cornerstones of this approach is Article 6.2 of the Paris Agreement, which advocates for collaborative climate action. The emphasis is on transparency, honest accounting, and ensuring no emission reduction is double-counted.

Japan’s Joint Crediting Mechanism (JCM)

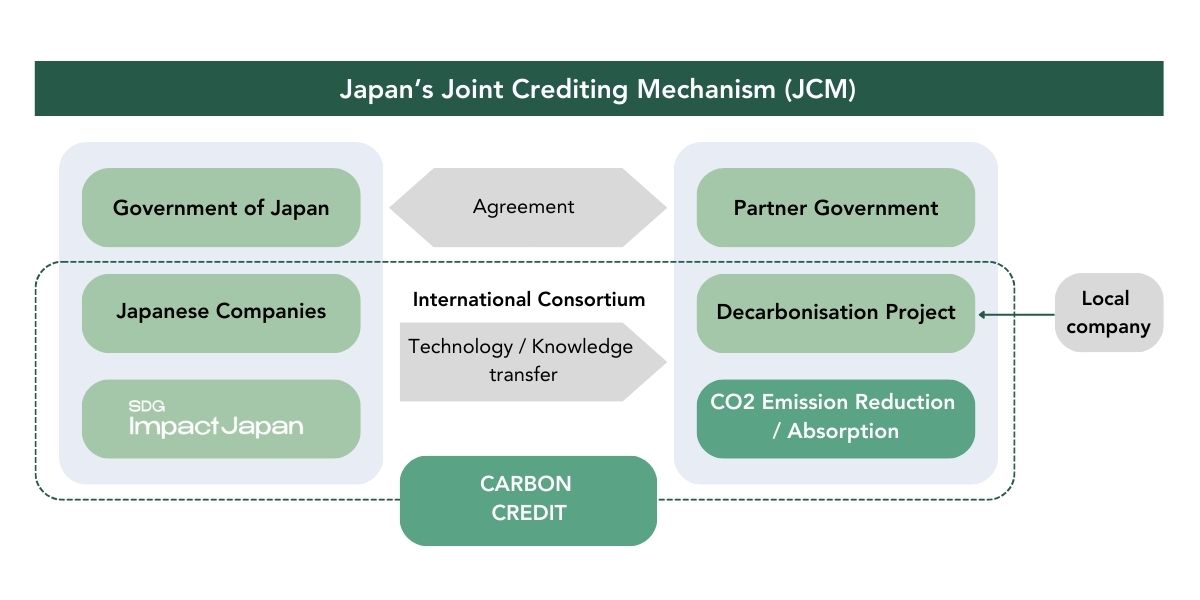

The JCM represents a collaborative initiative between Japan and developing nations to address greenhouse gas emissions. Its core purpose is to assess the amount of emission reductions achieved through cooperative projects, which can then be recognized as contributions by both Japan and the partner country towards fulfilling their respective Nationally Determined Contributions (NDCs) under the Paris Agreement.

Central to the JCM is the promotion of advanced decarbonization technologies, products, systems, services, and infrastructure in developing nations. By facilitating the diffusion of these state-of-the-art solutions, the mechanism ensures that partner countries are equipped with the latest tools and methodologies to mitigate their emissions effectively.

Japan’s commitment to the JCM is twofold. On one hand, it allows for the quantitative evaluation of Japan’s contributions to the greenhouse gas emission reductions achieved in partner nations. On the other, it drives public-private partnerships where private enterprises invest in decarbonizing technologies and infrastructure, while the public sector offers governance, facilitation, and in certain cases, financial backing. The overarching goal of such synergies is the attainment of an accumulated emission reduction of approximately 100 million t-CO2 by the fiscal year 2030.

As of July 2023, Japan has entered JCM partnerships with 27 countries. These collaborations are holistic, encompassing not just investments, but also feasibility studies, administrative support, and a structured approach to project processes, ensuring that each endeavor is in harmony with the broader objectives of the Paris Agreement.

In Practice: Empowering Indonesia’s Renewable Drive

SDG Impact Japan is committed to addressing the climate finance gap. We prioritise climate change mitigation through investing in sustainable infrastructure projects in emerging markets, such as renewable energy and energy efficiency. We work with the Government of Japan’s Joint Crediting Mechanism and leverage both our decarbonization finance expertise, and our global network to source compelling projects in emerging markets.

One tangible success story is the collaboration between SDG Impact Japan and Indonesia. In alignment with the Financing Programme for JCM Model Projects in FY2022, SDG Impact Japan supports a 3.5MW hydro-power project in Northern Sumatra. The project, partnered with PT. Raisan Energi Indonesia and Alamport Inc., is expected to reduce CO2 emissions by 8,863 tons annually.

This endeavour significantly supports Indonesia’s government-backed policy of encouraging investments in renewable energy infrastructure to drive its environmental targets. Additionally, the project will play a pivotal role in fulfilling carbon reduction goals as stipulated by the Paris Agreement. It will issue carbon credits under the JCM, in accordance with Article 6.2, to aid both Japanese and Indonesian governments in their pursuit of greener emissions profiles.

The road ahead

The challenge posed by climate change is undeniably vast, but innovative mechanisms like JCM showcase a roadmap towards a sustainable future. As more nations collaborate and tap into market-based solutions, there’s renewed hope for a balanced, green, and inclusive global economy.

References:

-

- UNFCCC. 2022. Summary and recommendations by the Standing Committee on Finance: Fifth Biennial Assessment and Overview of Climate Finance Flows, Bonn: UNFCCC.

本資料は情報提供と教育のみを目的としたものであり、いかなる商品の売買を勧誘するものではありません。本情報は投資助言とみなされるものではなく、また、取り上げた証券、商品、サービスがいかなる投資家にも適していることを表明するものでもありません。投資家は、十分な情報に基づいて投資判断を下す過程において、本資料に含まれるいかなる情報にも依存しないようお勧めします。本資料には市場分析が含まれている場合があります。本資料で明示的または黙示的に示されたアイデア、意見、および/または予測、含まれる情報、図表、または例はすべて、情報提供および教育目的のみのものであり、市場への投資、取引、および/または投機を推奨するものと解釈されるべきではありません。ここに明示または黙示されたアイデア、意見、および/または予測に照らして行われる投資、取引、および/または投機は、金銭的、またはその他のリスクで行われるものです。本サイトは、税務上または法律上のアドバイスを提供するものではありません。また、本資料に掲載されている情報は、有価証券の勧誘、売買、有価証券の処分、有価証券の売買注文の勧誘、有価証券の売買注文の勧誘、有価証券の売買注文の勧誘、有価証券の売買注文の勧誘、有価証券の売買注文の勧誘、有価証券の売買注文の勧誘、有価証券の売買注文の勧誘、有価証券の売買注文の勧誘、有価証券の売買注文の勧誘、有価証券の売買注文の勧誘、有価証券の売買注文の勧誘、有価証券の売買注文の勧誘を行うものではありません。