RI Japan 2024に弊社CISOサシャ・べスリックが登壇いたします

RI Japan 2024Venue: Toranomon Hills ForumDate: 22-23 May 2024Session: Plenary 3: Countering the anti ESG backlash, does Japan have a meaningful role to play? https://www.peievents.com/en/event/ri-japan

5/6 日本経済新聞に当社カーボンクレジット事業について掲載されました

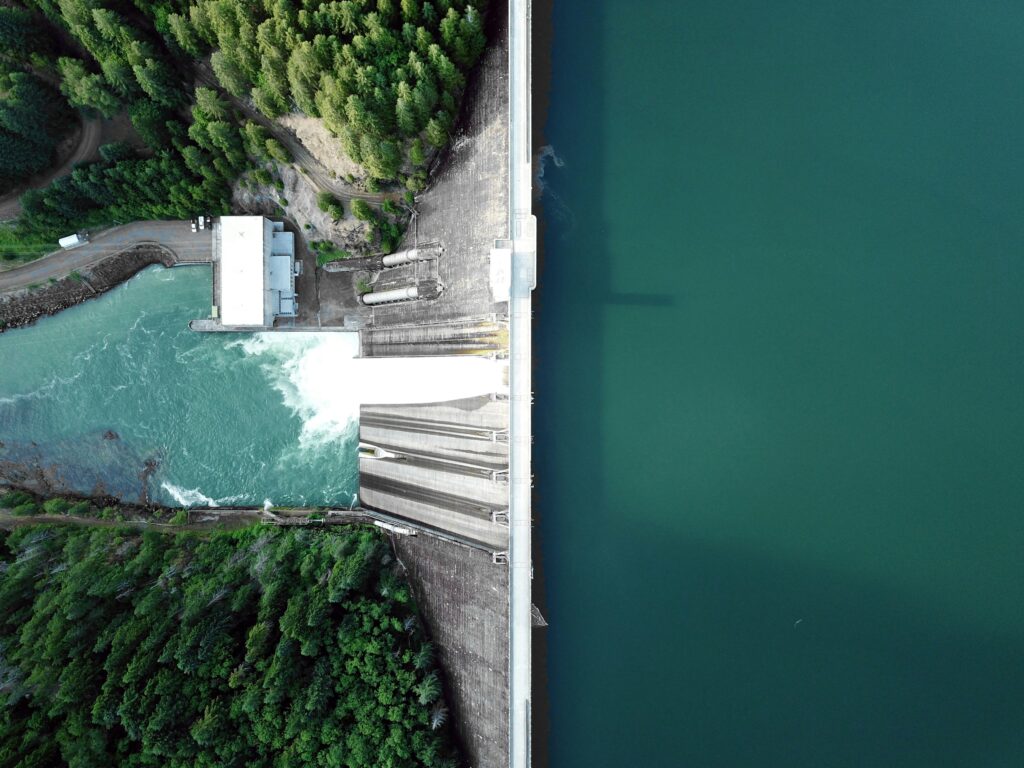

The Nihon Keizai Shimbun published an article about our support for the introduction of renewable energy in emerging countries such as Indonesia, Mongolia, and Turkey. https://www.nikkei.com/article/DGXZQOUC0863M0Y3A201C2000000/

4/24発売の財界・2024年春季特大号に特別座談会の記事が掲載されました

Under the theme of “What is the role of finance in solving social issues such as SDGs and ESG? The article featured a special roundtable discussion among Mr. Kamezawa, President of Mitsubishi UFJ Financial Group, Mr. Nagashima, President of Meiji Yasuda Life Insurance Company, and Mr. Tanika, Chairman of the Board of Directors of Zaikai Corporation. Also published in Zaikai ONLINE on 5/6 https://www.zaikai.jp/articles/detail/3915/1/1/1

SDGインパクトジャパン 新経営体制のお知らせ

SDG Impact Japan Inc. hereby announces a change in the Co-CEO and new management structure of SDG Impact Japan, Inc. (“SIJ”), a company specializing in sustainable finance, effective April 1, 2024, as follows. 1.Details of Management Structure Changes Current Title New Title Bradley Busetto Co-CEO Director, Vice Chairperson Shohei Maekawa COO Co-CEO 2.Background of Management Structure Changes Since our founding in 2021, we have been developing incubation and fund businesses together with our strategic partners with the mission of promoting innovation and creating new capital flows for the next generation of sustainable society. Since its founding, through a wide range of businesses centered on the promotion of sustainability, including the […]

芙蓉総合リース株式会社からのAgFunder SIJ Impactファンドへの追加出資に関するお知らせ

SDG Impact Japan Inc. (CEO: Mari Kogiso, hereinafter “SIJ”) and AgFunder Asia Pte. (Executive Director: John Friedman, hereinafter “AgFunder”), a Singapore-based venture capital firm jointly announced that Fuyo General Lease Co., Ltd. (Chiyoda-ku, Tokyo; Hiroaki Oda, President and Chief Executive Officer; hereinafter “Fuyo Lease”) has committed to invest in AgFunder SIJ Impact Fund (hereinafter “Fund”), an impact fund investing in agri-tech and food-tech (SIJ is participating as an impact management advisor to the fund). The current LP investors are Asahi Group Holdings, Meiji Holdings, Kewpie Corporation, and NAKASHIMATO Co.. Sustainability in the agriculture and food sectors is one of the most important issues in the realization of the SDGs. In […]

co-CEO小木曽麻里が出演した広告作品が日経BPマーケティング大賞を受賞しました

The Japan International Cooperation Agency (JICA)’s advertisement “The Future of Ukraine and the World with Akira Ikegami and us”, which our co-CEO Mari Kogiso has appeared, won the Grand Prix at the 10th Nikkei BP Marketing Awards (2024). https://www.nikkeibp.co.jp/atcl/newsrelease/corp/20240304/ https://www.nikkei.com/article/DGXZQOUC297UL0Z20C24A2000000/

SusHi Tech Tokyo 2024 Global Startup Programのアンバサダーに就任いたしました

We are pleased to announce that we have been appointed as ambassadors of SusHi Tech Tokyo 2024 Global Startup Program. SusHi Tech Tokyo 2024 Global Startup Program” is the largest scale global innovation conference in Asia and the only one of its kind in Japan, which creates “unseen encounters” with startup ecosystems in Japan and abroad to solve common urban issues worldwide. Date: May 15-16, 2024Location: Tokyo Big Sight, West Exhibition Halls 1 & 2Hybrid event of on-site and online (Booths will be held only at the venue) Organizer: SusHi Tech Tokyo 2024 Global Startup Program Executive Committee https://sushitech-startup.metro.tokyo.lg.jp/en/

CEO小木曽が日本経済新聞朝刊・健康経営研究会の広告に起用されました

CEO Kogiso was featured in an advertisement for the Health Management Research Group that was published in the morning edition of the Nihon Keizai Shimbun on February 26th.She comments on the challenges and prospects for how companies should approach women’s health issues. https://kenko-keiei.jp/3178/

サステナクラフトと自然由来のカーボンクレジットファンド設立に向け業務提携契約を締結

The 10-billion-yen Nature Commitment Fund aims to acquire 9 million tons of nature-based voluntary and JCM credits. sustainacraft Co., Ltd. (Headquarter: Chiyoda-ku, Tokyo, Representative Director: Hiroshi Suetsugu, hereafter “sustainacraft”) and SDG Impact Japan (Headquarter: Chiyoga-ku, Tokyo, Co-CEO Mari Ogiso, hereafter “SIJ”) has agreed on working together to mobilize investment in high-quality nature-based carbon credits. The Nature Commitment Fund (hereafter referred to as “the Fund”) will be operated by SIJ Climate LLC, a fully-owned subsidiary of SDG Impact Japan. The Fund aims to raise a total of 10 billion yen in 2024 to invest in carbon credit projects generating 9 million tonnes of CO2 emissions reduction Background and fund overviewNature-based solution […]

co-CEO小木曽のインタビュー記事が日経ビジネスに掲載されました

An interview with coCEO Mari Kogiso was featured in Chapter 4 of “The Future of Ukraine, the World, and Us”, a tie-up article between Nikkei Business and JICA. https://special.nikkeibp.co.jp/atclh/ONB/23/jica1115/chapter04/